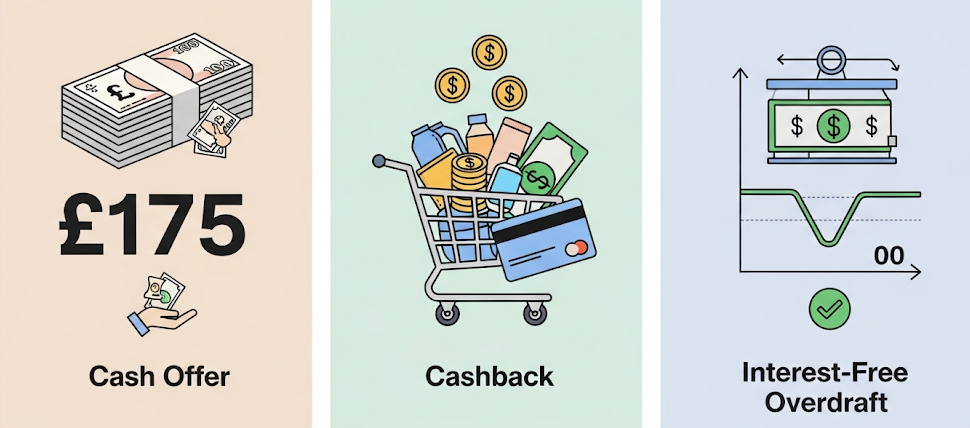

If you’ve been surfing the web wondering how to earn free money this year, the First Direct £175 switch offer is probably blowing up your feed. Spoiler: It’s legit. One of the UK’s most trusted banks is giving out cold hard cash—£175 of it—just for switching your current account over.

But don’t just click and hope. In this detailed guide, we’ll walk you through exactly how to get the bonus, who qualifies, and what to watch for so you don’t miss a penny. Whether you’re a student trying to stretch your money, a professional optimizing your financial stack, or a retiree wanting an easy win—this article has your back.

First Direct Sets Dates for £175 Payouts

| Feature | Details |

|---|---|

| Offer Name | First Direct £175 Switch Incentive |

| Eligibility | New customers only; no HSBC account since Jan 1, 2018 |

| Requirements | Pay in £1,000, make 5 debit card purchases, log in, switch with 2+ DDs |

| Switching Tool Used | Current Account Switch Service (CASS) |

| Time Limit to Qualify | 45 days from account opening |

| When You’ll Get Paid | By the 20th of the month after you complete all requirements |

| Bonus Stacking Possible? | Yes – stack up to £35 extra via cashback sites like Quidco or TopCashback |

| Official Website | First Direct Offer Page |

If you’re eligible and follow the steps, this is a no-brainer. The First Direct £175 switch offer is one of the best-value, least-fuss deals out there. Add in the cashback stacking trick, excellent bank reviews, and no monthly fees—and this isn’t just a quick win, it’s a smart move for long-term peace of mind.

So if your current bank isn’t cutting it—or you’re just ready for that free cash—jump on this while it’s hot.

Why Are Banks Handing Out Free Money?

Banks, just like streaming services and gyms, want your loyalty. Instead of asking for it, they’re buying it. First Direct knows that once you experience their stellar customer support and easy-to-use mobile app, you’ll probably stay.

So, this £175 is their version of a “free trial”—except it’s you who gets paid. Sounds fair, right?

Plus, the competition is heating up. According to the UK’s Current Account Switch Service (CASS), over 1.3 million people switched banks in 2024, chasing better deals, perks, and digital features.

Step-by-Step: How to Qualify for the £175 Bonus

Let’s break it down real easy. Here’s the play-by-play to make sure you get your bonus.

Step 1: Make Sure You’re Eligible

Before you get too excited, you’ve gotta pass the checklist:

- You’ve never had a First Direct account before (not even joint).

- You’ve not held a current account with HSBC since Jan 1, 2018.

- You’re a UK resident and 18+ years old.

Even if you closed your HSBC account a few years ago, it still counts. Their system remembers you.

Step 2: Open a First Direct 1st Account

Head over to the First Direct switch page and open their 1st Account. During the process, make sure you opt for the Current Account Switch Service (CASS).

This system:

- Moves all your payments over (DDs and standing orders).

- Transfers your money.

- Closes your old account.

- Does it all within 7 working days.

Step 3: Complete These Tasks in 45 Days

To unlock the cash bonus, you must do all four of these things within 45 days of account opening:

- Pay in £1,000 (can be all at once or in chunks).

- Set up at least 2 Direct Debits or Standing Orders via the switch.

- Make 5 debit card purchases (no cash withdrawals, gambling, or card-to-card transfers).

- Log into your First Direct mobile or online banking at least once.

Pro Tip: Take screenshots or set reminders so you don’t forget these tasks!

Step 4: Wait for the Bonus

Once you’ve ticked every box, just sit back. First Direct will credit £175 to your account before the 20th of the month following when you finished the steps.

Example: If you complete all tasks by September 3, you’ll get paid by October 20.

Bonus Tip: Stack an Extra £30–£35 with Cashback Sites

If you love optimizing your finances, here’s the hack:

- Sign up at TopCashback or Quidco

- Search for First Direct’s offer

- Click through their link before starting your application

You could pocket an extra £30–£35, on top of the £175. That’s over £200 free for maybe an hour’s work total.

How First Direct Stands Out (with Stats)

Don’t just chase the money—First Direct is worth sticking with, too.

- Rated #1 for customer service in the UK in several polls

- Offers 24/7 human customer support

- Access to a 7% AER Regular Saver account

- No overseas transaction fees

And while other banks like Barclays or Santander have their own offers, they usually come with more strings attached, like needing a mortgage or spending £500+ monthly.

First Direct’s £175 Offer vs. Other Perks

Bank switching offers change frequently, but here’s how First Direct’s £175 payout often stacks up against other typical incentives:

| Feature | First Direct (£175 Offer) | Typical Cashback Offer (e.g., £100) | Typical Overdraft Perk (e.g., £250 interest-free) |

| Main Benefit | Upfront Cash Payout | Cash back on spending | Interest-free borrowing |

| Eligibility | New customers, specific actions | Varies (e.g., minimum spend) | Subject to status, credit checks |

| Payout Type | Lump sum | Incremental over time | Cost saving, not direct cash |

| Simplicity | Relatively straightforward | Can require ongoing tracking | Useful if you need to borrow |

| Ideal For | Boosting savings, quick reward | Regular spenders | Those needing short-term credit |

What Could Go Wrong (And How to Avoid It)

- Missing the deadline: If you don’t do all the tasks in 45 days, you’re out of luck.

- Spending on the wrong things: Only regular purchases count. No cash withdrawals or gambling.

- Switching from the wrong bank: If your old bank isn’t part of CASS, the switch won’t qualify.

- Closing your account too soon: Keep your First Direct account open until after the 20th of the bonus payout month.

FAQs

Can I open a joint account and still qualify?

Nope—only personal accounts qualify for the switch bonus. Also, only one £175 bonus per customer.

Is the £175 taxable?

Nope. It’s a cash reward, not interest or earned income. So no taxes owed.

Can I switch again after getting the bonus?

Yes, but you must keep the account open until your bonus is paid, or you’ll forfeit it.

Does switching hurt my credit score?

Not directly. Using CASS doesn’t impact your credit score. But if you apply for the optional overdraft, that can trigger a soft credit check.

How soon can I repeat this switch trick?

There’s no official cooldown, but once you’ve claimed First Direct’s bonus, you won’t qualify again. You can switch to another bank later for their bonus though (like Nationwide or TSB).

Smart Uses for Your £175 Bonus

Not sure what to do with that cash? Here are ideas that blend fun and financial smarts:

- Pay off a credit card balance

- Set it aside for Christmas or birthday gifts

- Invest it in a robo-advisor (e.g., Nutmeg or Moneybox)

- Start an emergency fund with a 7% Regular Saver from First Direct

- Treat your family to a meal out—guilt-free!