In July 2025, eligible Canadians will receive a one-time GST/HST Credit payment of up to $250. This extra financial relief comes as part of the government’s efforts to ease the burden of rising living costs, particularly for low- and middle-income households. The GST/HST Credit, a long-standing support program, helps offset the taxes people pay on goods and services. Here’s everything you need to know about this payment – from eligibility to practical steps on how to ensure you get it.

Canadians Set to Receive $250 GST Credit in July 2025

| Key Points | Details |

|---|---|

| What is the GST Credit? | A government benefit providing financial support for low- to middle-income individuals and families. It helps offset the GST/HST (Goods and Services Tax/Harmonized Sales Tax) paid. |

| Amount of Credit | Up to $250 for single individuals, $375 for couples, plus an additional $85 per eligible child under 19 years of age. |

| Payment Date | July 28, 2025 |

| Eligibility | Must be a Canadian resident for tax purposes, be at least 19 years old, and have filed a 2024 tax return. Income thresholds apply. |

| How to Apply | No separate application needed; file your 2024 income tax return on time. Ensure your personal details are up to date with the CRA. |

| Official Resources | For full eligibility and application details, visit the official Canada Revenue Agency GST Credit Page |

The $250 GST/HST Credit arriving in July 2025 will offer financial relief to many Canadians who need it most. By following the simple steps to file your tax return and ensuring your information is current, you can easily claim this benefit. It’s a small but significant step toward easing the financial burden of Canadians across the country.

What is the GST/HST Credit?

The GST/HST Credit is a non-taxable payment provided by the Canadian government to help eligible individuals and families offset the cost of the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) they pay on goods and services. It’s a program that directly helps those who need it most, primarily focusing on individuals and families with low to moderate incomes.

While GST and HST are national taxes applied to most goods and services in Canada, not everyone feels the pinch equally. For lower-income households, these taxes can take up a more substantial portion of their budget, making the GST/HST Credit a vital support tool.

In July 2025, a special $250 payment will be issued to eligible Canadians, providing a much-needed boost for families, students, or anyone struggling with rising costs of living.

Why Is This Important?

The GST/HST Credit offers a cushion for Canadians facing the economic squeeze of inflation, especially when coupled with other benefits, such as the Canada Child Benefit (CCB). For many families, this credit isn’t just a nice-to-have – it’s a crucial part of their financial well-being, helping them make ends meet.

Real-Life Example

Imagine a single mother living in Toronto, trying to manage her household on a fixed income. Between groceries, rent, and transportation, every penny counts. The extra $250 from the GST Credit can mean the difference between paying the rent on time or falling behind. For this mother, the GST Credit isn’t just an extra – it’s a lifeline.

Similarly, a retired couple in Calgary living on a modest pension may find that the extra funds help them cover prescription costs or small home repairs they might otherwise have had to delay.

These real-world examples show how the GST/HST Credit impacts a wide range of Canadians, from single parents to retirees, making it a significant part of the Canadian social safety net.

Eligibility Requirements for the GST/HST Credit

To be eligible for the July 2025 GST/HST Credit, you need to meet specific requirements. Let’s break these down:

1. Canadian Residency

You must be a Canadian resident for tax purposes to receive the credit. If you live in Canada or have lived here for most of the year, you’re likely a resident. However, if you’re a non-resident or moved out of the country, you won’t qualify.

2. Age Requirement

You need to be at least 19 years old to qualify. However, if you’re under 19 and live with a spouse or common-law partner, or have children under 19, you may still qualify.

3. Filing Your Tax Return

Even if you didn’t earn any income, filing your 2024 tax return is crucial to determining your eligibility for the GST/HST Credit. The CRA uses this tax return to assess your eligibility and determine how much you’ll receive.

4. Income Thresholds

Income plays a critical role in determining the amount of credit you qualify for. If you have a low to moderate income, you’ll likely qualify for a higher credit amount. Families with children, particularly those with a large number of dependents, will see even more significant amounts.

Amount of Credit

Here’s a breakdown of how much you could receive based on your family size and income level:

| Family Type | GST/HST Credit Amount |

|---|---|

| Single Individual | Up to $250 |

| Married/Partnered Couple | Up to $375 |

| With One Child (Under 19) | Up to $460 (includes $85 per child) |

| With Two Children (Under 19) | Up to $545 (includes $85 per child) |

These amounts are intended to ease the financial burden, and many people find that this credit helps cover the costs of groceries, household items, or even small debts.

How to Apply for the GST/HST Credit

Applying for the GST/HST Credit is a simple process. You don’t need to apply separately. As long as you file your 2024 tax return on time, you’ll automatically be considered for the credit. Here are the steps you need to follow:

Step 1: File Your 2024 Tax Return

Regardless of whether you earned income, file your tax return. This is the most important step in qualifying for the GST/HST Credit. You can file your return using online software, through a tax preparer, or by paper form.

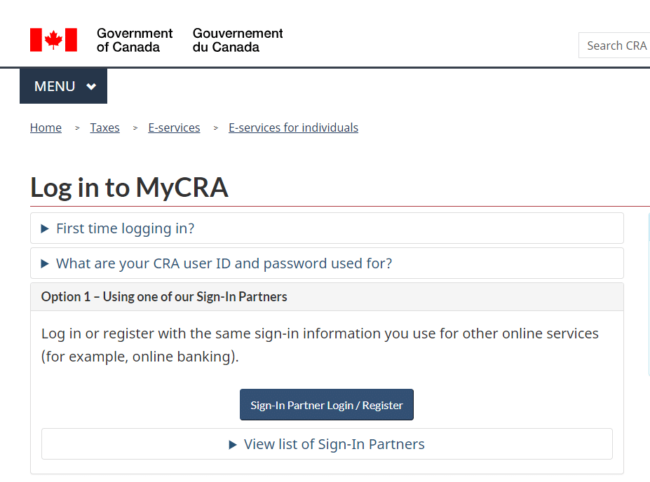

Step 2: Update Your Personal Information

Ensure your personal details, such as your address and banking information, are correct in your CRA My Account. This helps ensure you get your payment quickly and without delay.

Step 3: Check Your Eligibility

After filing, you can log into your CRA My Account to check the status of your GST/HST Credit. If you don’t have an account yet, consider creating one to track your benefits and other government services.

Expert Opinion: Why Filing Your Taxes is Crucial

According to financial expert John Harper, “Many Canadians underestimate the importance of filing their taxes on time, even if they haven’t earned much or any income. The GST Credit, along with other benefits, relies on accurate and up-to-date tax filings. People need to recognize that filing is their key to accessing these vital funds.”

Potential Pitfalls to Watch Out For

While applying for the GST/HST Credit is straightforward, there are a few pitfalls you should watch out for:

- Missing the Filing Deadline: If you don’t file your tax return on time, you could miss out on the credit for the year.

- Outdated Personal Information: If the CRA doesn’t have your current address or banking information, it might delay your payment.

How Does the GST/HST Credit Compare to Other Benefits?

The GST/HST Credit is just one part of Canada’s extensive support system for low-income families. It’s similar to other programs like the Canada Child Benefit (CCB) or Employment Insurance (EI), but it specifically targets those who feel the pinch from sales taxes. For a well-rounded financial plan, you may also want to explore these other benefits to maximize your government support.

FAQs

1. When will I receive my payment?

The GST/HST Credit will be deposited on July 28, 2025. If you have direct deposit set up with the CRA, the payment will go directly to your bank account. If not, a cheque will be mailed to you.

2. What if I miss the deadline to file my tax return?

If you miss the deadline to file your 2024 tax return, you may not receive the payment on time. Make sure to file promptly to ensure your payment is processed.

3. Can I receive the GST Credit if I’m on social assistance?

Yes! As long as you meet the eligibility criteria, you can still qualify for the GST/HST Credit even if you are receiving social assistance or other government benefits.

4. How do I check if I qualify for the GST Credit?

You can check your eligibility status through your CRA My Account online. It’s the easiest way to stay on top of your benefits.