Starting July 1, 2025, Australians relying on Centrelink payments are in for a significant update. The Australian government has increased payments to align with the rising cost of living. This move is part of the regular indexation process, ensuring benefits keep pace with inflation and are fair for those who need them most. If you’re a Centrelink recipient or have a loved one who relies on these payments, the new changes could directly affect you. This article breaks down everything you need to know.

Centrelink Payments Reach New Milestones in July 2025

| Key Point | Details |

|---|---|

| Payment Increase | Centrelink payments increased by 2.4% across various benefits, including Age Pension, JobSeeker. |

| Target Recipients | Over 2.4 million Australians will benefit from this increase. |

| Age Pension | Single recipients could see an extra $19/fortnight, while couples may get up to $34.50 more. |

| JobSeeker Payment | Recipients aged 22 and older could see about $14 extra per fortnight. |

| Family Tax Benefit (FTB) | FTB A increases to $227.36 per fortnight for kids under 13; FTB B rises to $193.34. |

| Youth Allowance & Austudy | Increased payments to provide more financial support for students and apprentices. |

| Asset & Income Thresholds | Raised to allow more individuals to qualify for benefits. |

The new Centrelink payment increases effective from July 1, 2025, are a welcomed change for many Australians. Whether you’re receiving the Age Pension, JobSeeker, Family Tax Benefit, or Youth Allowance, these increases can help make life a little more affordable. With the rising cost of living, it’s essential to stay informed about these changes and take the necessary steps to ensure your payment details are accurate. So, don’t wait – log into your myGov account today, update your details, and get ready to benefit from the new payment increases.

The July 2025 Centrelink Payment Changes: Why They Matter

Centrelink is an essential part of the Australian welfare system, providing financial support to millions of Australians in need. With inflation affecting everyday costs, these payments must be regularly updated to ensure they provide adequate support. On July 1, 2025, the Australian government implemented a 2.4% increase across several key Centrelink benefits.

This change is part of the government’s broader strategy to support individuals and families who are struggling with the high cost of living, particularly amid rising energy prices, rent hikes, and other expenses. If you’re a Centrelink recipient, or if you know someone who relies on these benefits, it’s important to understand exactly how these increases could affect you.

How Does the Payment Increase Work?

The 2.4% increase will impact a range of benefits, from the Age Pension to JobSeeker and Family Tax Benefits. The idea behind these regular indexations is to ensure that payments don’t lose value over time due to inflation. Here’s how it breaks down:

- Age Pension: This is one of the most widely claimed Centrelink payments. For singles, the increase will amount to approximately $19 more per fortnight. Couples will receive up to $34.50 extra. These increases could help many Australians better cope with rising living costs.

- JobSeeker Payment: Individuals receiving JobSeeker payments will also see an increase. Adults aged 22 and over can expect an extra $14 per fortnight. While this might not sound like much, for many recipients, every dollar counts.

- Family Tax Benefit (FTB): The Family Tax Benefit has received a solid increase. For children under 13, FTB A will rise to $227.36 per fortnight, while FTB B (for single-income families) will increase to $193.34 per fortnight. This adjustment is designed to provide better support for working families, especially those with multiple children.

- Youth Allowance & Austudy: These payments, aimed at students and apprentices, have also been adjusted to reflect the increasing cost of living. Students and apprentices often face unique financial struggles, and these increases can make a big difference in their day-to-day lives.

Real-Life Impact: How These Changes Affect Australians

Let’s take a look at some real-life examples of how these payment increases benefit everyday Australians:

- Sandra, a single mum from Melbourne, works part-time and receives Family Tax Benefit B. Sandra says the additional $7.50 per fortnight will help her cover her child’s school expenses, which have increased recently. “It’s not a huge amount, but it helps keep us afloat, especially with the price of groceries going up,” Sandra shared.

- Greg, a retiree in Queensland, receives the Age Pension. He’s grateful for the extra $19 per fortnight. “The cost of healthcare is going up every year. That $19 is a relief. It’ll help with medical bills, and I won’t have to cut back on things like going to the doctor.”

- Chris, an apprentice from Adelaide, depends on Youth Allowance to get by while learning his trade. The increase in payments will allow him to buy better tools for his work. “It’s been tough living on the allowance, so even a small increase like this is significant for me.”

Centrelink Payments: 2024 vs. 2025 – A Quick Look

| Payment Type/Factor | Before July 2025 (e.g., 2024 Rates) | From July 2025 (New Milestones) | Impact on You |

| Family Tax Benefit Part A | Lower maximum rates | Higher max rates: e.g., $227.36/fortnight (under 13), $295.82/fortnight (13+) | More support for families with children. |

| Family Tax Benefit Part B | Lower maximum rates | Higher max rate: e.g., $193.34/fortnight | Increased assistance for single-income families. |

| Paid Parental Leave | 20 weeks, no super | 22 weeks, with superannuation | More time at home and a boost to your retirement savings. |

| Age Pension Age (New Applicants) | Up to 66 years, 6 months | 67 years | May need to work longer before accessing the Age Pension. |

| Superannuation Guarantee | 11.5% | 12% | More money going into your super fund for retirement. |

The Economic Ripple Effect of These Payment Increases

These increases are not just helpful for the recipients themselves – they can have a broader economic impact as well. When Centrelink recipients receive more money, they tend to spend it right away on essential goods and services. This increase in consumer spending can stimulate local businesses, from grocery stores to healthcare providers. As people have more disposable income, they are more likely to spend money on local businesses, thus creating a positive economic ripple effect.

Centrelink Services Beyond Payments: A Holistic Approach

While the payment increase is a significant step, it’s important to remember that Centrelink offers a wide range of other services that many Australians may not be aware of. Beyond financial assistance, Centrelink provides support for mental health, housing, and financial counseling.

- Mental Health Support: Centrelink partners with mental health organizations to offer support services. If you’re struggling, Centrelink can connect you with the right mental health resources.

- Financial Counseling: If managing your finances on a tight budget feels overwhelming, Centrelink’s financial counselors can help guide you through managing debts, bills, and even savings.

- Housing Assistance: Centrelink offers access to subsidized housing and rental assistance for low-income Australians, making it easier to secure affordable accommodation.

Common Mistakes to Avoid When Managing Centrelink Payments

Managing Centrelink payments effectively is essential, and avoiding common mistakes can save recipients from overpayments or delays. Here are a few tips:

- Failing to Update Information: Make sure your income, assets, and family details are updated regularly in your myGov account to avoid incorrect payments.

- Not Applying for All Available Payments: Many people miss out on benefits like the Family Tax Benefit or Rent Assistance because they don’t realize they qualify.

- Not Reporting Changes Promptly: If your circumstances change – whether it’s a change in income or living situation – report it as soon as possible to Centrelink.

Steps for Applying for Centrelink Benefits

If you’re unsure how to apply for Centrelink benefits, here’s a step-by-step guide:

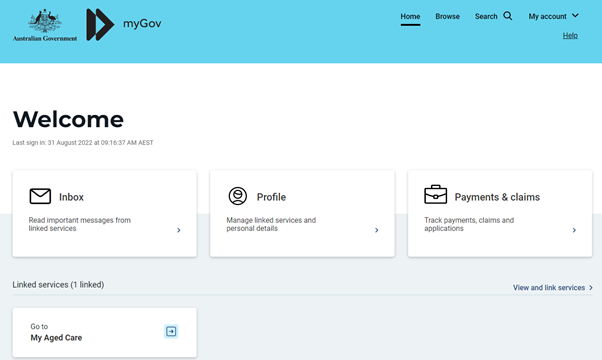

- Create a myGov Account: Visit the myGov website to create an account. This will be your gateway to accessing Centrelink services.

- Link Your Centrelink Account: Once your myGov account is set up, link your Centrelink account to manage payments and services.

- Complete the Application: Follow the prompts to complete your application. Make sure to provide all the required documents, such as proof of identity and income.

- Submit and Monitor: Submit your application and monitor your payments regularly through your myGov account.