If you’re over State Pension age and not already claiming Pension Credit UK, you could be missing out on more than £4,300 every year. Yep, you read that right. That’s real money that could be sitting in your account — money meant to help with daily costs like heating, food, and rent. Shocking part? Over 850,000 eligible pensioners still don’t claim it.

Now, whether you’re a retiree looking to stretch every pound, a family member trying to help a loved one, or a professional supporting vulnerable seniors, this guide will break it all down for you — plain, simple, and straight to the point.

What is Pension Credit? More Than Just a Top-Up!

Pension Credit is a vital benefit designed to top up the income of pensioners in the UK, even if they have some savings or other small pensions. It’s separate from your State Pension and can unlock a whole host of other financial support, like help with Council Tax, Housing Benefit, and even a free TV licence for those aged 75 and over. Many people who are eligible don’t claim it, missing out on crucial support!

Pension Support: Then and Now

While the State Pension has been a cornerstone of support for over a century (dating back to the Old Age Pension in 1909), the landscape of additional pensioner benefits has evolved significantly. In the past, support was often more fragmented. Today, through benefits like Pension Credit (introduced in 2003 to combat pensioner poverty), the government aims to provide a more comprehensive safety net, bundling together various forms of financial assistance. However, the onus remains on individuals to claim these benefits, leading to the substantial amounts currently going unclaimed.

Pensioners Losing £4300 Every Year

| Key Info | Details |

|---|---|

| Average Annual Benefit | £4,300 via Guarantee Credit |

| Who Can Apply | State Pension age (66+), low income/savings |

| Additional Perks | Winter Fuel Payment, Housing Benefit, free TV Licence |

| Savings Threshold | Under £10,000 (more allowed with deductions) |

| Claim Method | Online, by phone (0800 99 1234), or post |

| Backdate Claim? | Yes, up to 3 months |

| Eligibility Check | Gov.uk Pension Credit Calculator |

If you or someone you know is over State Pension age, checking Pension Credit eligibility is a no-brainer. It’s tax-free, easy to claim, and opens the door to thousands more in help.

You worked for this. You earned it. And with costs rising, there’s zero reason to miss out on what’s rightfully yours.

You could even get support from Age UK, Citizens Advice, or your local council. They’ll help you walk through the process step-by-step.

So go ahead, make that call, check that website, or talk to someone who can help. Your peace of mind is worth it.

What Is Pension Credit? (And Why It Matters)

Pension Credit is a benefit from the UK government to top up income for people who have reached State Pension age and have a low income. It comes in two parts:

- Guarantee Credit: Tops your income to a minimum weekly level.

- Savings Credit: Extra reward for modest savings or income if you reached pension age before April 6, 2016.

This ain’t charity. It’s support you earned. The average unclaimed amount per household is over £4,300/year, and it’s linked to tons of other free benefits — from free NHS dental to reduced utility bills.

Pro Tip: Even getting as little as £1 in Pension Credit unlocks other major perks, including the £300 Winter Fuel Payment and free TV licence if you’re over 75.

Why Are So Many Missing Out?

Great question. According to DWP data, about 1 in 3 eligible pensioners don’t claim Pension Credit. That’s nearly £2 billion left on the table every year. Why?

- Folks assume they won’t qualify.

- It sounds complicated (spoiler: it’s not).

- Some think savings or home ownership disqualify them (wrong again).

You can own a home and still qualify. And savings under £10,000 don’t affect your claim at all.

Real Talk: Many older folks don’t know help exists or are too proud to ask. If you know someone like that, share this info. You could change their life.

Am I Eligible for Pension Credit?

Here’s the lowdown:

- You must live in England, Scotland, or Wales.

- You (or your partner) must be over State Pension age.

- Your weekly income is below:

- £201.05 if you’re single

- £306.85 if you’re a couple

Have savings? If it’s under £10,000, you’re good. If it’s over, it might affect how much you get — but it doesn’t disqualify you.

Example: Sam, age 70, gets £185/week in pension, owns his home, and has £8,000 in savings. He qualifies for about £16/week, or £832/year — and he unlocks Winter Fuel Payments and free dental.

What Can Pension Credit Get Me Besides Cash?

Claiming even a small amount of Pension Credit can get you:

- Free NHS dental and optical care

- Cold Weather Payment (£25/week during very cold periods)

- Free TV Licence (if 75+)

- Housing Benefit or help with rent/mortgage

- Warm Home Discount (£150 towards energy bills)

- Council Tax reductions

- Carers Allowance top-up if you’re caring for someone

- Free school meals for grandchildren in your care

This isn’t just about a few pounds a week. It’s peace of mind, real savings, and safety during cold winters.

How to Apply for Pension Credit: Step-by-Step

1. Check Your Eligibility

Use the official gov.uk calculator or call 0800 99 1234.

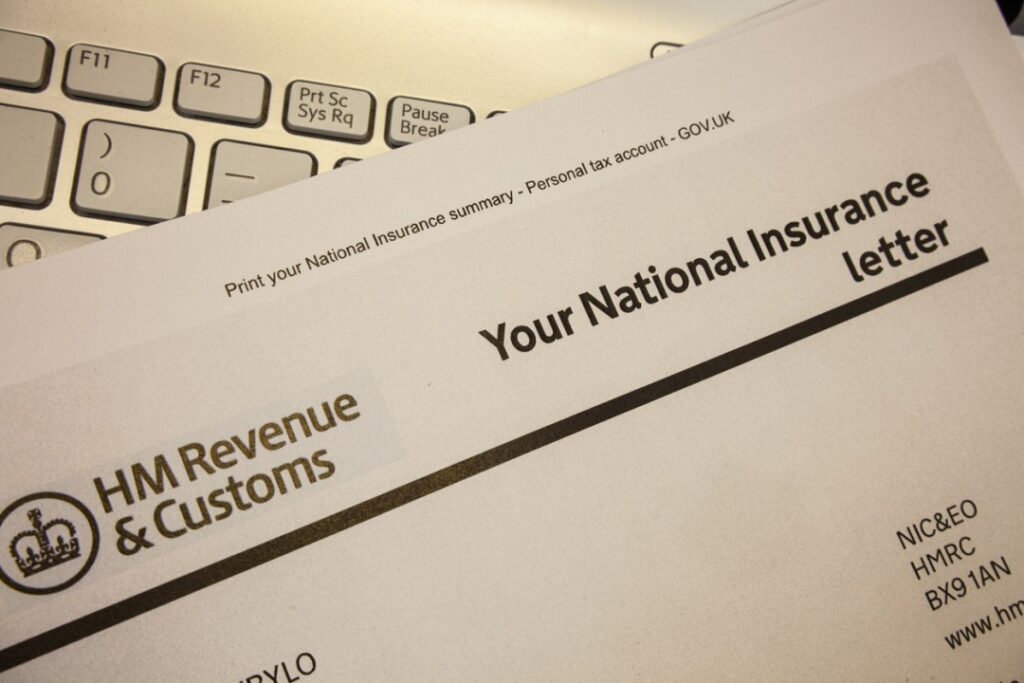

2. Gather Your Info

You’ll need:

- National Insurance number

- Bank account details

- Info about income (state/private pensions)

- Housing costs (rent, mortgage)

- Savings and investments

3. Apply Online or by Phone

- Online: Gov.uk Pension Credit

- Phone: 0800 99 1234 (Mon to Fri, 8am to 6pm)

- Post: Request and return the paper form

4. Wait for a Decision

Most claims are processed within 35 to 50 working days.

5. Backdated Payments

If eligible, you can get up to 3 months back pay from the day you apply.

Pro Tip: If your claim gets denied, you can request a mandatory reconsideration. Don’t give up after the first try!

Common Myths Debunked

“I own a house, so I won’t qualify.” False. Home ownership doesn’t affect eligibility.

“I have some savings, so I’m out.” Nope. Savings under £10,000 don’t impact your claim. Over that, it reduces a little, but not much.

“The process is too confusing.” Not really. It’s a quick form and maybe a phone call. Plus, Citizens Advice and Age UK can help you for free.

“I don’t want to rely on benefits.” Pension Credit is not charity. It’s a right. You’ve paid into the system for decades. This is your return.

FAQs

Q1: What’s the maximum I can get? Depends on your income. Guarantee Credit tops you up to £201.05 (single) or £306.85 (couple).

Q2: Is Pension Credit taxable? Nope, it’s completely tax-free.

Q3: Can I claim if I live with family? Yes, as long as you’re financially independent and meet the income test.

Q4: What if I already get other benefits? You may still qualify. Pension Credit can be added on top or reduce the taper of other benefits.

Q5: I missed last year. Can I claim retroactively? You can only claim back 3 months. So don’t wait.

Q6: Can I help someone else apply? Yes, you can apply on behalf of a friend or relative with their permission. Carers, social workers, or family members often do this.

Q7: Is there a deadline? There is no set deadline, but you can’t backdate beyond 3 months, so earlier is better.