Big changes are coming, and your wallet could be in the crosshairs. Chancellor Rachel Reeves has signaled that the UK could see £10–40 billion in tax hikes this autumn. These aren’t just political rumors—they’re serious budget-saving moves that will affect millions across the country. Whether you’re a small business owner, first-time buyer, or just trying to make ends meet, it’s time to understand what’s ahead and prepare.

What’s a “Warning Shot” in Politics? When we say a politician “sends a warning shot,” it’s like a signal. It means they’re hinting at potential actions to come, often to influence public opinion or prepare for policy changes. In this case, Rachel Reeves, as Chancellor of the Exchequer, is indicating that significant tax adjustments might be on the horizon, getting everyone ready for what could be a challenging autumn.

A Look Back: How UK Taxation Has Evolved

The UK’s tax landscape is always shifting. Historically, taxes were often introduced to fund specific needs, like the Napoleonic Wars. Income tax, for instance, was initially a “temporary” measure! Over time, the tax burden has fluctuated, with significant changes in the post-war era to fund the welfare state, and more recently, an increasing trend to address national debt and public spending. The current discussions around new tax hikes are happening at a time when the UK’s tax burden is already forecast to reach its highest post-war level, making any further increases particularly impactful.

Reeves Sends a Warning Shot

| Topic | Insight | Why It Matters |

|---|---|---|

| Budget Gap | £6.25 billion hole due to scrapped welfare cuts | Triggering need for new revenue |

| Expected Tax Hikes | £10–40 billion | Could affect every income group |

| Likely Targets | Income Tax, NIC, VAT, CGT, Fuel Duty, Council Tax, Stamp Duty | Most common revenue levers |

| Who’s Affected | Working families, businesses, property buyers | Universal impact |

| Historical Echo | Last seen post-2008 and 2020 COVID response | Shows cyclical policy behavior |

| Official Resource | HM Treasury | Government’s financial hub |

The Autumn 2025 Budget is shaping up to be a pivotal one. With £10–40bn in tax hikes potentially on the table, every worker, business owner, and taxpayer should get informed, stay flexible, and plan ahead.

Understanding your position—and moving now—can help you protect your finances, ease the shock, and even find new opportunities in uncertain times.

What’s Happening – and Why?

Reeves reversed major welfare reforms—like cutting Personal Independence Payments (PIP) and winter fuel payment support. These reversals, while popular, blew a £6.25bn hole in the government’s fiscal plan.

Her message? “There’s no magic money tree.” To fund services like NHS, education, and pensions while maintaining economic credibility, taxes will likely rise. Economists from the Institute for Fiscal Studies estimate between £10bn and £40bn will be raised in the Autumn 2025 Budget, expected late October.

The 7 Tax Hikes That Might Drop

1. Income Tax

May involve rate increases or threshold freezes.

| Income Level | Potential Extra Tax (estimate) |

|---|---|

| £30,000 | ~£180/year |

| £60,000 | ~£450/year |

| £100,000 | ~£900+/year |

Tip: Increase pension contributions to lower your taxable income.

2. National Insurance Contributions (NIC)

Could return to pre-2022 levels (or higher), raising costs for employees and employers.

For self-employed people: Keep an eye on Class 2/4 NIC rate hikes.

3. VAT Adjustments

Standard rate may rise (from 20%), or exemptions could be slashed. This directly affects consumer goods, services, and business expenses.

4. Fuel Duty Hike

Frozen since 2011, but inflation pressure could end that. Every 3p rise per litre means £60–£90 more per year for drivers.

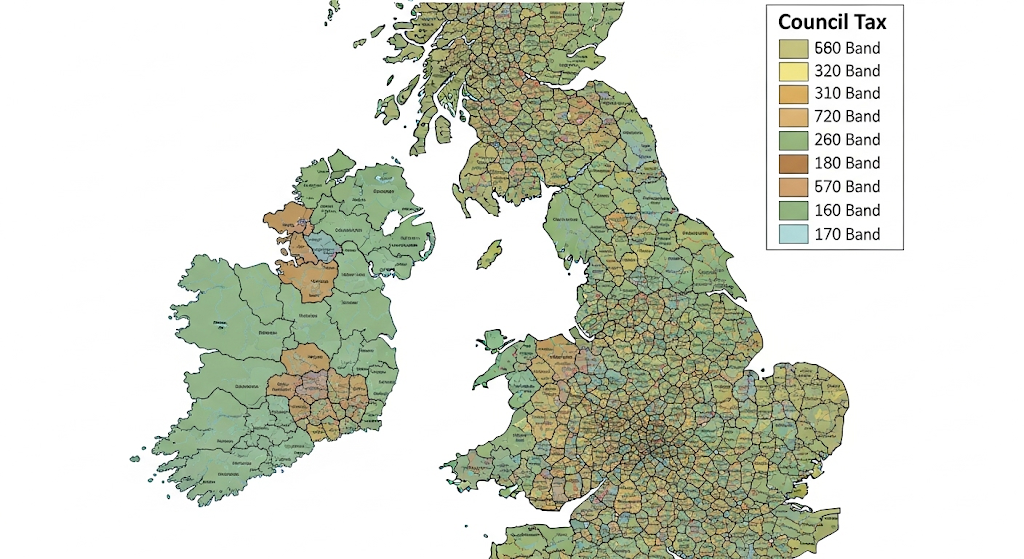

5. Council Tax

Local authorities may get more freedom to raise rates—particularly to support social care and housing programs.

6. Capital Gains Tax (CGT)

Could align with income tax rates or see threshold cuts. Investors and landlords, watch your property portfolios.

7. Stamp Duty or Wealth Tax

A “super rate” for expensive properties or a recurring tax on wealth bands is being floated by policy groups.

A Quick Look Back

After the 2008 crash, the UK hiked VAT from 17.5% to 20%. In 2020, furlough spending led to frozen tax bands (fiscal drag). History says: when deficits rise, tax hikes follow.

“If you want strong public services, someone’s gotta pay for it.” – Paul Johnson, IFS

Global Comparison

| Country | Recent Tax Move | Trigger |

|---|---|---|

| USA | IRA 2022 raised corporate taxes | Inflation control |

| Germany | Wealth levy in talks | Energy subsidies |

| Canada | Hiked GST & carbon taxes | Climate spending |

UK trends are part of a wider post-pandemic rebalancing.

Personas: How It Affects Real People

Sally – School Teacher (£38k salary)

- Hit: Income tax increase

- Plan: Increase pension contributions and check eligibility for childcare tax relief

Mohammed – Self-employed Builder (£52k profit)

- Hit: NIC & VAT increases

- Plan: Use simplified expenses, reinvest in tools to lower profits

Linda – Retired, Owns 2nd Property

- Hit: CGT & Stamp Duty changes

- Plan: Consider selling before Budget or gifting assets

Current vs. Potential Tax Landscape: A Quick Look

Here’s a simplified comparison of current tax situations and what some of the proposed changes might look like. Please note: These are illustrative and based on potential scenarios mentioned in the article.

| Tax Category | Current Situation (as of July 2025) | Potential Change (Likely from April 2026) | Who it Might Affect Most |

| Income Tax | Personal allowance and thresholds largely frozen until 2028 | Potential adjustments to higher rates or frozen thresholds impacting more earners | Middle to higher-income earners |

| Capital Gains Tax | Recent increases (e.g., property CGT to 24%) | Further increases, particularly on non-real estate assets or certain investments | Individuals selling investments, second homes, or businesses |

| National Insurance | Employer contributions recently increased to 15% | Potential further adjustments or changes to thresholds for both employers and employees | Employees and businesses |

| Inheritance Tax | Allowances frozen, some reliefs restricted from April 2026 | Broader inclusion of pension funds in estates, further relief restrictions | Individuals with significant assets and their beneficiaries |

| VAT | Standard rate remains at 20% | Potential increases on certain goods or services | All consumers |

Navigating Potential Tax Changes: Top Tips & Common Mistakes

Don’t get caught off guard! Here are some helpful tips and common mistakes to avoid:

- Do review your current financial situation, including your income, investments, and savings.

- Do consider speaking to a qualified financial advisor or tax consultant to understand how potential changes might affect you personally.

- Do stay informed by following official government announcements and reputable financial news.

- Don’t panic or make hasty financial decisions based on speculation. Wait for official policy details.

- Don’t assume that all proposed changes will necessarily pass or be implemented exactly as rumored. Policies can evolve.

- Don’t rely solely on anecdotal evidence; always cross-reference information with official sources.

What the Heck Does That Mean?

| Term | Plain English |

|---|---|

| NIC | What you and employers pay into for pensions & NHS |

| VAT | Tax added to goods & services |

| CGT | Tax on the profit you make when you sell assets |

| Stamp Duty | Tax paid when buying property |

| Thresholds | Income level where tax kicks in |

How to Prepare: Step-by-Step

- Review your current tax position

Use tools like MSE’s Tax Calculator. - Maximize tax shelters

Fill up your ISA allowance and contribute to pensions. - Time big purchases or sales

Property, shares, or business deals may be cheaper if done before new rates hit. - Track the Budget Date

Likely in late October 2025—watch HM Treasury News. - Speak with a financial adviser

Especially for business owners or those selling property.

Frequently Asked Questions

Q: Will everyone pay more tax?

A: Not guaranteed—but most middle-income earners and above may see a rise.

Q: Can I reduce what I owe legally?

A: Yes. Use pensions, ISAs, CGT allowances, and tax-deductible business expenses.

Q: Are benefits affected?

A: Possibly indirectly. Budget gaps from tax cuts may tighten public spending elsewhere.

Q: Will this change mortgages or interest rates?

A: Indirectly, yes. Gilt markets and investor confidence affect rates long-term.