The 2025 DWP Winter Fuel Allowance is back, and it’s more important than ever for older Americans and UK residents navigating colder months. With rising energy costs, this government-backed payment can help millions stay warm without breaking the bank. Whether you’re a retiree, a caregiver, or simply planning ahead for a loved one, understanding how to qualify, apply, and get the most from this support is key.

This guide breaks it all down in plain English—so whether you’re 10 or 70, you’ll walk away confident about how the 2025 Winter Fuel Payment works.

What is the Winter Fuel Allowance?

The Winter Fuel Allowance (officially known as the Winter Fuel Payment) is a fantastic support system designed to help older people in the UK with their heating bills during the colder months. It’s a non-means-tested, tax-free annual payment introduced by the government in 1997 to ensure pensioners can keep their homes warm and stay safe and comfortable throughout winter. Think of it as a little extra help when the temperatures drop!

A Journey of Support

The Winter Fuel Payment has evolved significantly since its introduction in 1997. Back then, it was a flat £20 payment for those aged 60 and over, a universal recognition of heating costs. Fast forward to 2024, and the scheme saw a temporary shift towards stricter means-testing, impacting millions. However, for 2025, there’s been a significant “U-turn” back towards broader eligibility. This means that while it’s not a return to full universality, a much wider group of pensioners – around 9 million in England and Wales – will once again receive this vital support, a clear sign of the government’s renewed commitment to assisting older people with their winter bills.

2025 DWP Winter Fuel Allowance

| Category | Details |

|---|---|

| Eligibility Age | Must reach State Pension age (66+) by 15–21 September 2025 |

| Income Limit | Taxable income must be £35,000 or less to receive payment without reclaim |

| Standard Payment | £200 per household if under 80, £300 if someone is aged 80+ |

| Couples | Payment is split between partners (e.g., £100 each if under 80) |

| Automatic Payment? | Yes, in most cases. Claim only needed if you’ve moved, live abroad, or other unique situations |

| Payment Period | Payments are sent November–December 2025 |

| Claim Deadline | Applications must be received by 31 March 2026 |

| Official Website | gov.uk/winter-fuel-payment |

The 2025 DWP Winter Fuel Allowance is a lifeline for millions of older adults across the UK. With an easy application process, clear eligibility rules, and helpful top-ups for those in need, this benefit can make a real difference during the cold season. Just make sure you apply (if needed), check your letter, and plan for payment in late 2025.

What is the Winter Fuel Allowance?

In short, the Winter Fuel Allowance (or Winter Fuel Payment) is a yearly tax-free benefit from the Department for Work and Pensions (DWP) to help older folks cover heating bills during the coldest time of the year. If you’re 66 or older by mid-September, you could be eligible.

It’s not means-tested, but there is an income threshold now: £35,000. If you earn more than that, you can still get the money—but HMRC will reclaim it later via taxes. Or, you can choose to opt-out altogether.

Why It Matters

With inflation pushing energy bills higher year after year, this allowance helps ensure pensioners and vulnerable people aren’t forced to choose between heating and eating.

Who Qualifies in 2025?

You will qualify if:

- You were born on or before 22 September 1959 (State Pension age)

- You lived in the UK during the “qualifying week” (15 to 21 September 2025)

- Your income is £35,000 or less (taxable)

You won’t qualify if:

- You live in a care home full-time and receive means-tested benefits

- You were in prison or in hospital long-term during the qualifying week

- You don’t have a right to reside in the UK

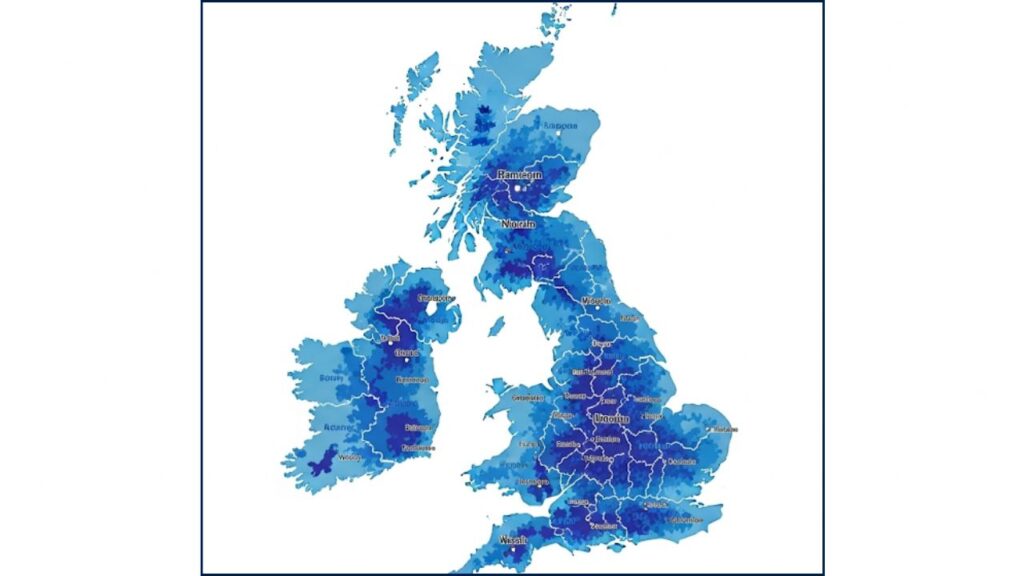

Pro Tip: If you’re in Scotland, your payment comes from Social Security Scotland under a separate scheme: Pension Age Winter Heating Payment.

How Much Will You Get?

Here’s the breakdown:

If You Live Alone

- Under 80: £200

- Over 80: £300

If You Live With Someone Who Also Qualifies

- Both under 80: £100 each

- One 80 or older: £100 (under 80) and £200 (80+)

If You Get Certain Benefits

If you’re on Pension Credit, Income Support, income-based JSA or ESA, the rules and payments can change slightly, and you may receive more or less depending on who you live with.

Fun Fact:

In 2024, over 8 million households received the Winter Fuel Payment, with the average amount around £200. That’s nearly £1.6 billion in total support.

How to Apply (Step-by-Step)

Step 1: Check if You Qualify

Visit GOV.UK or call 0800 731 0160. Most folks don’t need to apply if they already get State Pension or DWP benefits.

Step 2: Wait for the Letter

You’ll usually get a letter by October or early November saying how much you’ll get. If nothing arrives by January 2026, call the Winter Fuel Payment Centre.

Step 3: Apply If Necessary

If you live abroad, moved recently, or haven’t claimed before, fill out a claim form:

- Post: From 15 September 2025

- Phone: From 13 October 2025

- Deadline: 31 March 2026

When and How Will You Be Paid?

Payment Timeline:

- Begins: November 2025

- Ends: December 2025

You’ll receive the money directly into your bank account, tax-free. If there are any issues, contact DWP directly.

Personal Story:

“My dad, who’s 78, got his payment last year right before Thanksgiving. It covered nearly all his heating bill for December. This scheme really is a lifesaver for our elders,” says Mary, a family caregiver from Yorkshire.

2024 vs. 2025 Winter Fuel Payment Eligibility

Big changes are coming! Here’s a quick comparison to show you how eligibility has shifted from last winter to this upcoming one:

| Feature/Year | Winter 2024 (England & Wales) | Winter 2025 (England & Wales) |

| Primary Eligibility | Primarily for those receiving Pension Credit or other means-tested benefits. | All those of State Pension age. |

| Income Threshold | No specific income threshold (means-tested benefits apply). | Taxable income of up to £35,000 a year. If over, payment will be recovered via tax. |

| Automatic Payment | Generally automatic for those on qualifying benefits. | Largely automatic for all eligible pensioners. |

| Number of Pensioners Affected | Restricted to the lowest-income pensioners (around 2-3 million). | Expanded to around 9 million pensioners. |

| Opt-out Option | Not widely highlighted due to restricted eligibility. | An opt-out option will be introduced for those who don’t wish to receive it. |

Practical Tips to Maximize the Benefit

- Update Your Details: If you’ve changed address or bank, update DWP ASAP.

- Combine With Other Help: Use with other benefits like Cold Weather Payment or Warm Home Discount.

- Track Your Payments: Keep your bank records and letters for tax season.

- Opt-Out if Needed: Earning over £35,000? Fill out an opt-out form to avoid future tax deductions.

- Insulate Your Home: Combine your allowance with free insulation schemes to save even more.

- Get Energy Advice: Contact Simple Energy Advice for free guidance on cutting your energy bills.

Related Government Schemes

- Cold Weather Payment: Extra payments when temperatures drop below zero for 7 days.

- Warm Home Discount: £150 off electricity bills for eligible low-income households.

- Energy Bills Support Scheme: One-off support for general energy costs.

FAQs

Can I still apply if I live outside the UK?

Yes, in certain EEA countries or Switzerland. Use the international claim form.

Will it affect my other benefits?

No. It won’t count as income and won’t affect Pension Credit, Housing Benefit, etc.

What if my income changes after applying?

The income cap (£35,000) is checked through HMRC records, not live income. So it won’t change your eligibility retroactively.

Is the payment guaranteed every year?

Nope. It’s reviewed annually, so stay updated via gov.uk.

What if I didn’t get my payment?

Call the Winter Fuel Payment Centre at 0800 731 0160. They’ll check your eligibility and issue payment if needed.